Welcome to our website! We are excited to provide you with the information you need regarding IRS Form W-9. Whether you are a business owner or an individual, understanding the importance of this form is crucial when it comes to tax compliance. Today, we will guide you through everything you need to know about Form W-9 and where to find it.

What is IRS Form W-9?

IRS Form W-9, also known as the Request for Taxpayer Identification Number and Certification form, is a document used by businesses to collect essential information from independent contractors, freelancers, and vendors. This form is vital for reporting income paid to these individuals to the Internal Revenue Service (IRS).

It is important to note that Form W-9 should only be provided to individuals or entities that are U.S. citizens or resident aliens. Non-resident aliens and foreign entities should not complete this form. When filling out Form W-9, the taxpayer provides their name, address, Social Security Number (SSN), or Employer Identification Number (EIN), depending on their entity type.

It is important to note that Form W-9 should only be provided to individuals or entities that are U.S. citizens or resident aliens. Non-resident aliens and foreign entities should not complete this form. When filling out Form W-9, the taxpayer provides their name, address, Social Security Number (SSN), or Employer Identification Number (EIN), depending on their entity type.

Where can I find IRS Form W-9?

If you are in need of a blank Form W-9, you can easily access it from various reputable sources. Here are a few options:

- ZipBooks

ZipBooks provides a user-friendly platform where you can download the IRS Form W-9. Simply visit their website and click on the link to access the form. They also offer other valuable resources related to tax compliance for businesses.

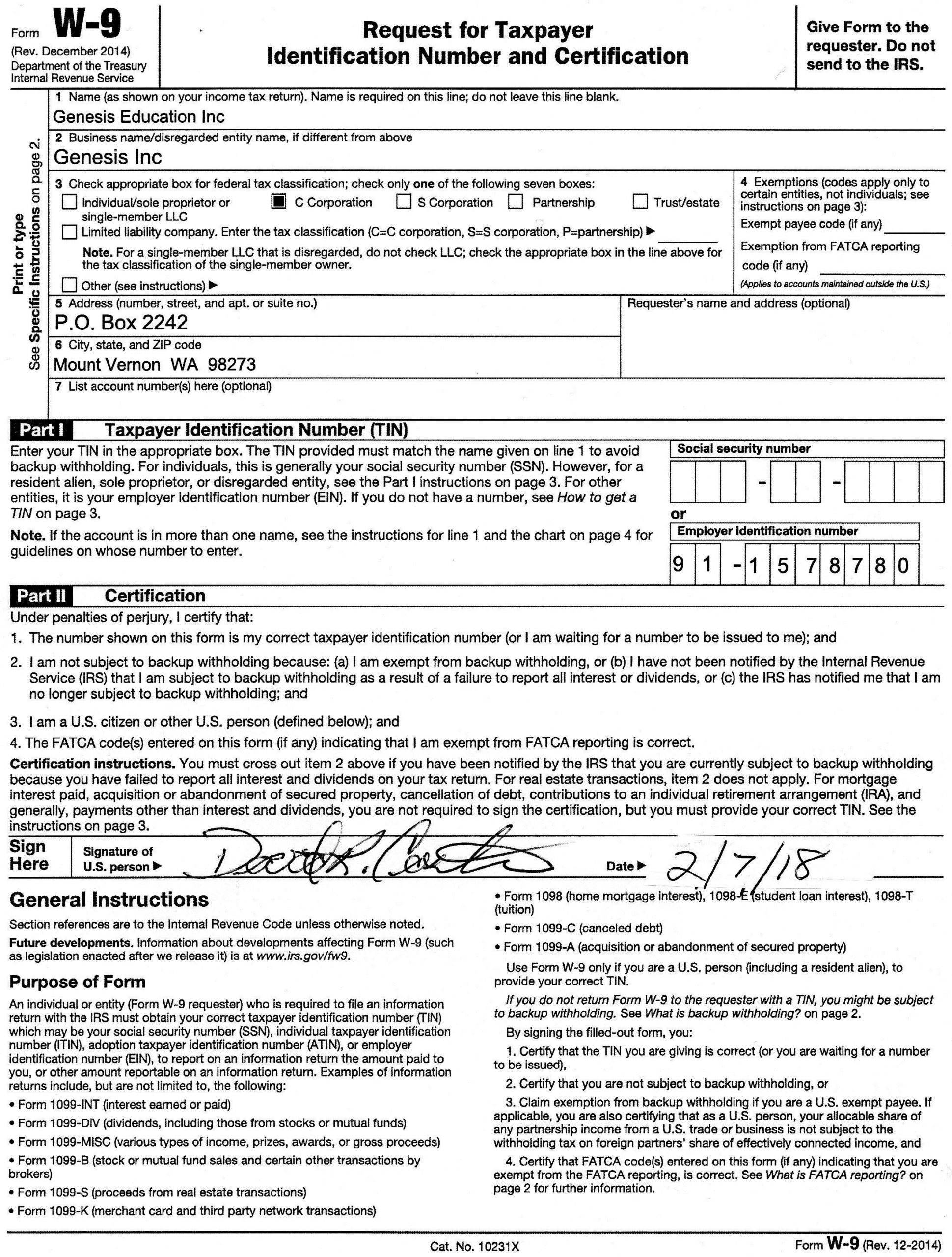

2. Prime Power LLC

2. Prime Power LLC

Another reliable source to find a printable version of Form W-9 is Prime Power LLC. They provide a downloadable and printable form that you can easily access. Their website offers an array of valuable resources related to tax compliance as well.

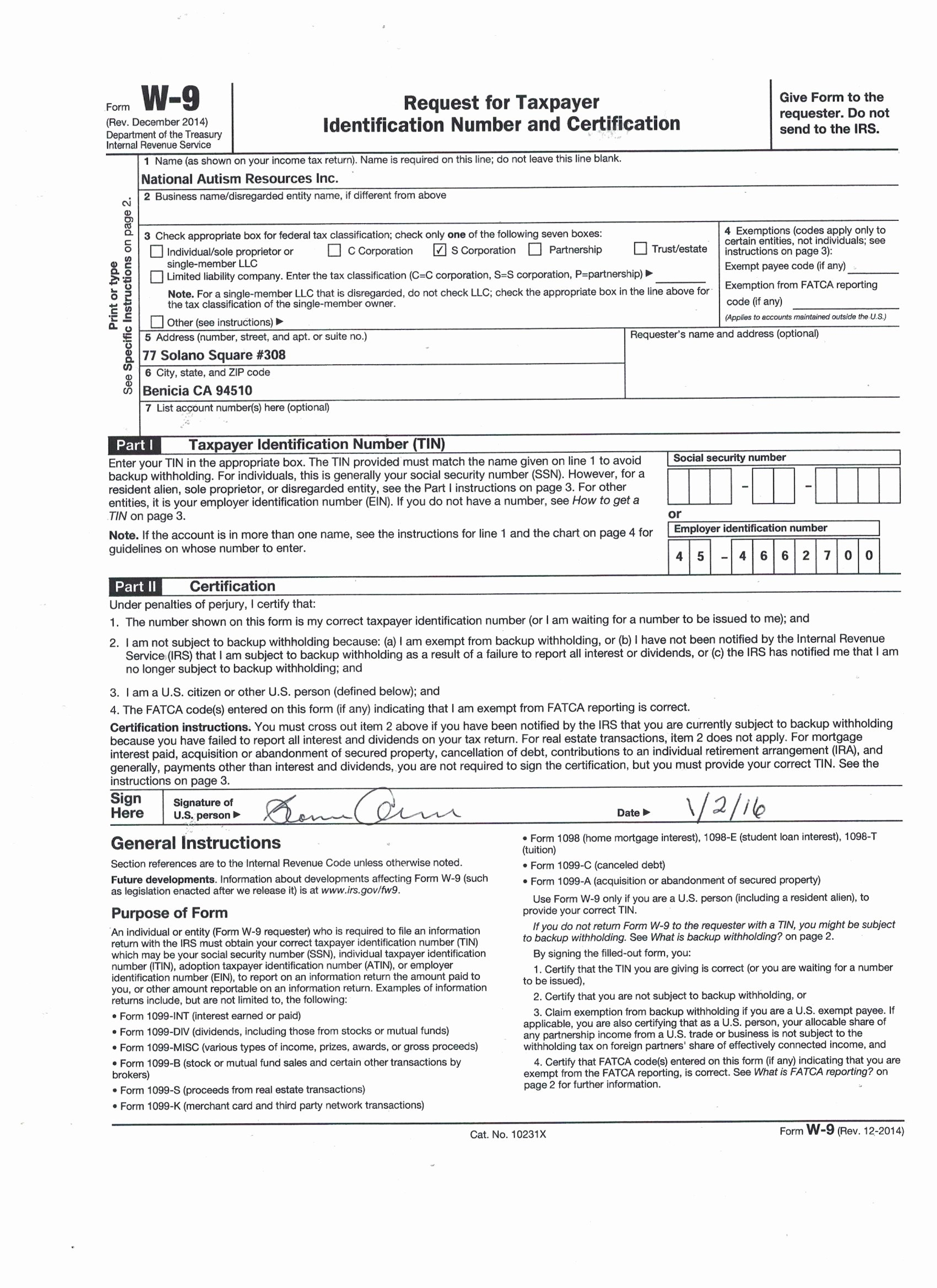

3. Oyungurup

3. Oyungurup

Oyungurup offers a printable Form W-9 for the year 2021. If you are looking for an updated version of the form, their website is a great place to find it. Ensure you have the most recent version to fulfill your tax obligations accurately.

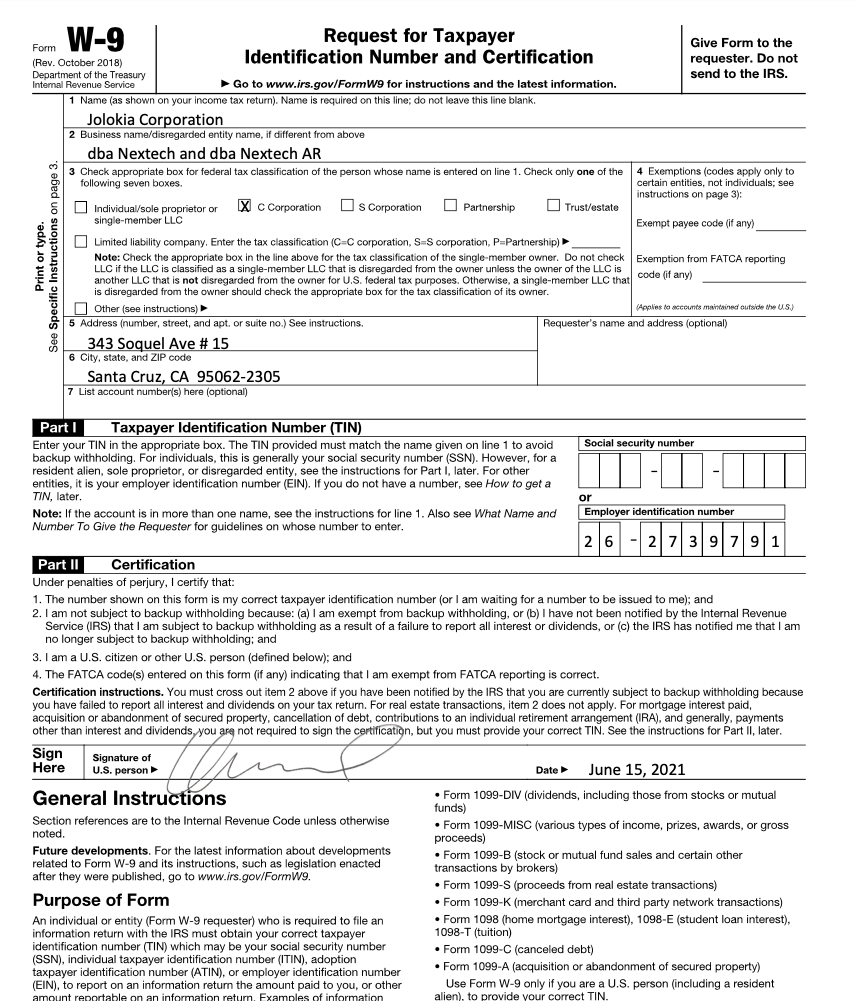

4. Nextechar

4. Nextechar

Nextechar provides a comprehensive approach for accessing the W-9 form by guiding you on where to find it. They offer information on various sources, including their own website, where you can find and download the form with ease.

Why is Form W-9 essential?

Form W-9 plays a critical role in tax compliance for both businesses and individuals. Here are a few reasons why this form is essential:

1. Information Reporting: Form W-9 allows businesses to collect necessary information from independent contractors and other individuals for accurate income reporting to the IRS. It ensures that businesses fulfill their tax obligations and report payments accurately.

2. Backup Withholding: If a taxpayer fails to provide their correct Taxpayer Identification Number (TIN) or provides false information, the payer may be required to withhold taxes at a specified rate. Form W-9 helps to prevent backup withholding by ensuring accurate reporting of information.

3. Verification: For businesses working with independent contractors, Form W-9 helps verify the contractor’s identity and taxpayer status. This is essential for maintaining accurate records and complying with tax regulations.

Conclusion

Conclusion

IRS Form W-9 is a crucial document for businesses when working with independent contractors and vendors. It ensures accurate reporting of income and helps maintain compliance with tax regulations. We hope this comprehensive guide has provided you with valuable insights and resources to easily access the W-9 form. Remember to consult with a tax professional for personalized advice regarding your specific situation. Stay informed and organized to meet your tax obligations seamlessly!

Please note that all the images used in this article are for illustrative purposes only and belong to their respective owners.