Hey y’all!

I just came across some helpful resources for filing the 1040X form, and I wanted to share them with you. Whether you’re amending your income tax return or need to make changes to your previous filing, these resources can guide you through the process. So, let’s dive right in!

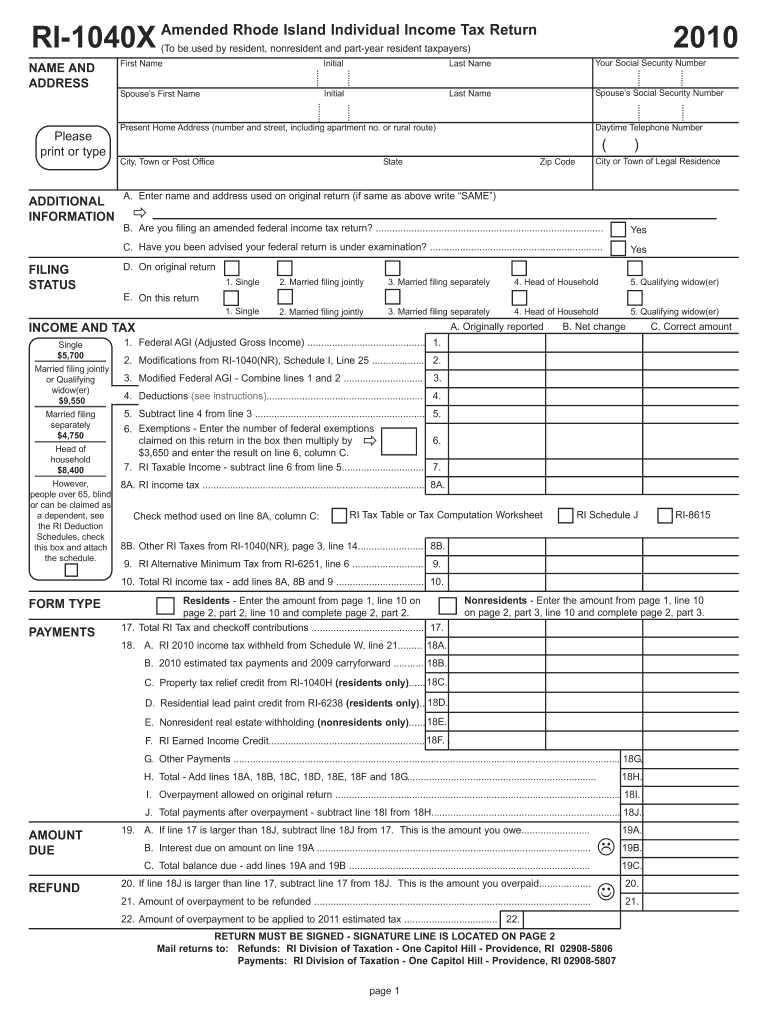

NJ 1040X Form - Fill and Sign Printable Template Online

The NJ 1040X form is a great tool for those residing in New Jersey who need to make amendments to their income tax return. This printable template can be filled out online and then signed electronically, making it convenient and easy to use. It provides a straightforward way to correct any mistakes or update your tax information.

The NJ 1040X form is a great tool for those residing in New Jersey who need to make amendments to their income tax return. This printable template can be filled out online and then signed electronically, making it convenient and easy to use. It provides a straightforward way to correct any mistakes or update your tax information.

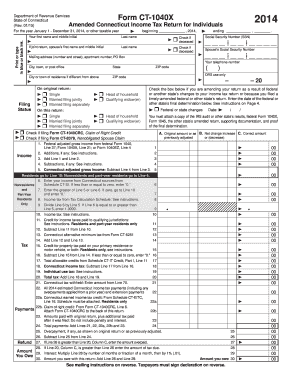

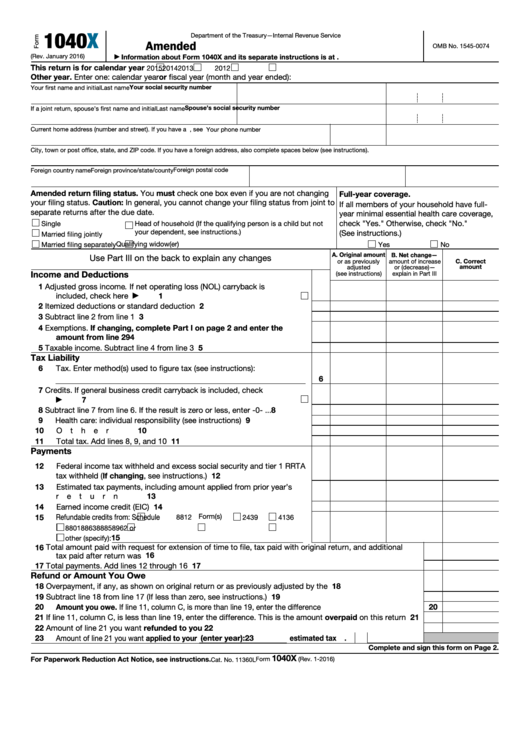

1040X Form - Fill Out and Sign Printable PDF Template | signNow

If you prefer using a PDF format, signNow offers a fillable and signable version of the 1040X form. You can easily fill in the required information, sign it digitally, and submit it electronically. This saves you the hassle of printing and mailing the form, making the entire process more efficient.

If you prefer using a PDF format, signNow offers a fillable and signable version of the 1040X form. You can easily fill in the required information, sign it digitally, and submit it electronically. This saves you the hassle of printing and mailing the form, making the entire process more efficient.

What Is Form 1040-X? Definition, Purpose, How to File With IRS

:max_bytes(150000):strip_icc()/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg) If you’re unsure about what Form 1040-X is all about, this Investopedia article provides a comprehensive definition and purpose of the form. It explains when and why you might need to file it with the IRS. Understanding the context and significance of the form can help you navigate through the amendment process more effectively.

If you’re unsure about what Form 1040-X is all about, this Investopedia article provides a comprehensive definition and purpose of the form. It explains when and why you might need to file it with the IRS. Understanding the context and significance of the form can help you navigate through the amendment process more effectively.

20 Printable 1040X Status Forms and Templates - Fillable Samples in PDF

If you’re looking for various printable 1040X forms and templates, this resource offers a collection of fillable samples in PDF format. Having multiple options at your disposal allows you to choose the one that best fits your specific needs and preferences. Take your time exploring the samples to find the one that resonates with you.

If you’re looking for various printable 1040X forms and templates, this resource offers a collection of fillable samples in PDF format. Having multiple options at your disposal allows you to choose the one that best fits your specific needs and preferences. Take your time exploring the samples to find the one that resonates with you.

Form 1040X Amended Income Tax Return | Legacy Tax & Resolution Services

If you’re seeking professional assistance with your amended income tax return or need expert advice, Legacy Tax & Resolution Services are here to help. Their website provides the Form 1040X for you to download and use. Additionally, they offer dedicated services to guide you through the amendment process, ensuring accuracy and compliance with IRS regulations.

If you’re seeking professional assistance with your amended income tax return or need expert advice, Legacy Tax & Resolution Services are here to help. Their website provides the Form 1040X for you to download and use. Additionally, they offer dedicated services to guide you through the amendment process, ensuring accuracy and compliance with IRS regulations.

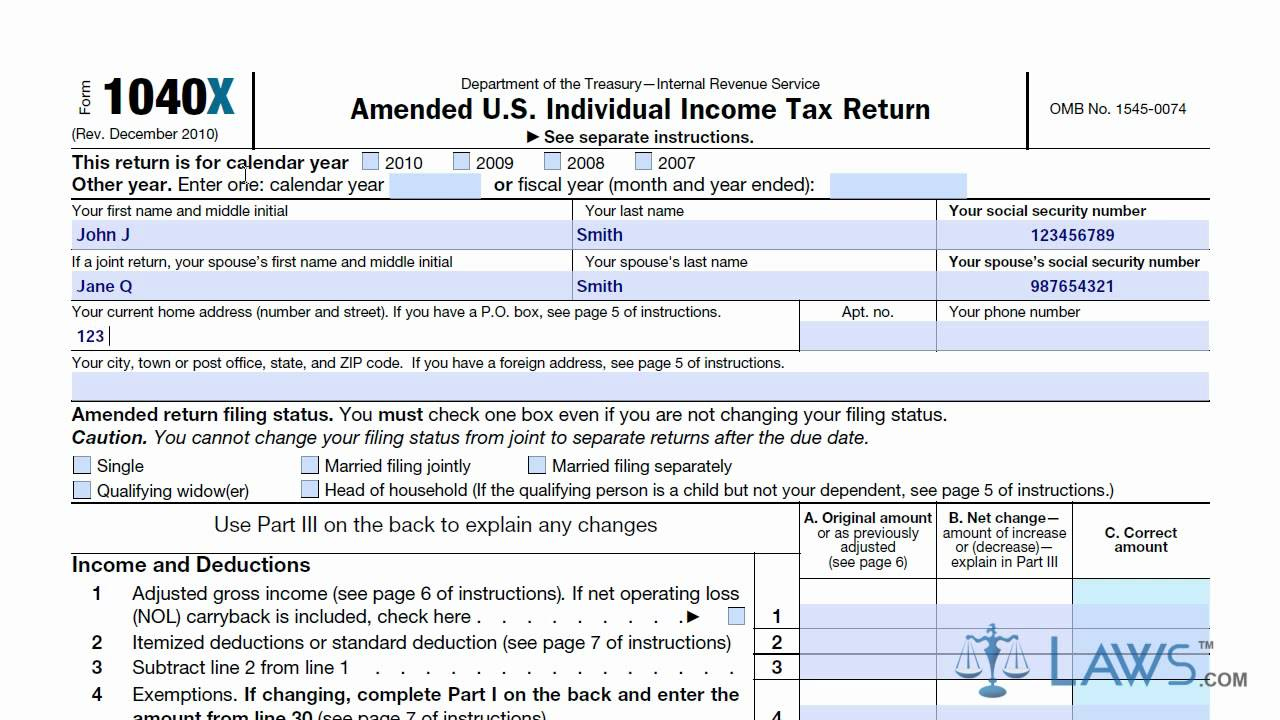

Learn How To Fill The Form 1040X Amended U S Individual | 1040 Form

If you prefer visual guidance, this resource provides a step-by-step tutorial on how to fill out the Form 1040X for amended U.S. individual income tax returns. The images and detailed instructions make it easier to understand and follow along, ensuring you complete the form accurately.

If you prefer visual guidance, this resource provides a step-by-step tutorial on how to fill out the Form 1040X for amended U.S. individual income tax returns. The images and detailed instructions make it easier to understand and follow along, ensuring you complete the form accurately.

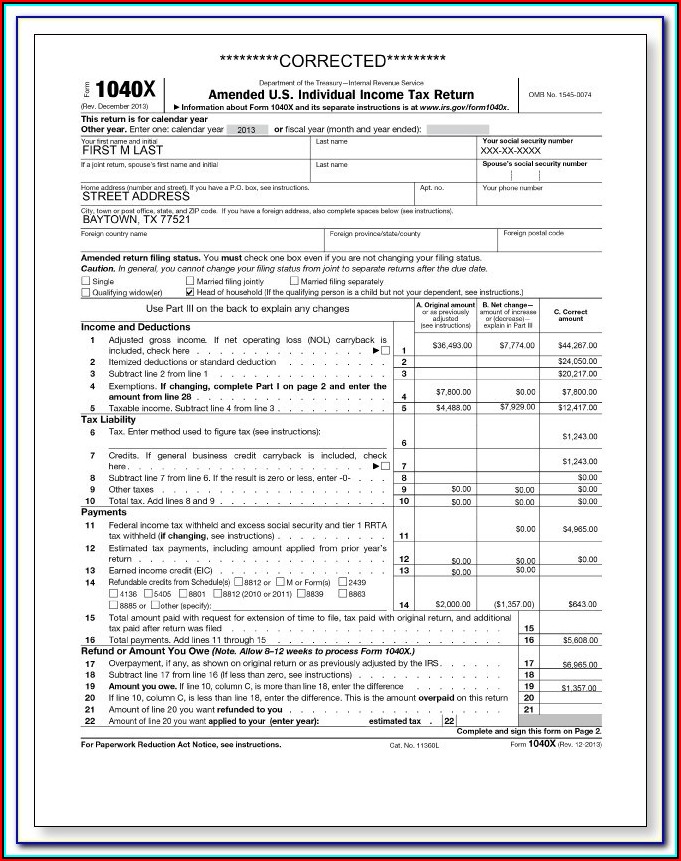

1040X Fillable Form - Form : Resume Examples #o7Y33rwYBN

If you’re looking for a fillable form that you can complete on your computer, this resume examples website provides a fillable version of the 1040X form. You can easily enter your information, save it, and make any necessary updates before submitting it to the IRS.

If you’re looking for a fillable form that you can complete on your computer, this resume examples website provides a fillable version of the 1040X form. You can easily enter your information, save it, and make any necessary updates before submitting it to the IRS.

Top 23 Form 1040X Templates Free to Download in PDF Format

Formsbank offers 23 different form 1040X templates that you can download for free in PDF format. These templates cover a wide range of scenarios, making it easier to find one that suits your specific needs. It’s always helpful to have options, especially when it comes to filing important documents like the 1040X form.

Formsbank offers 23 different form 1040X templates that you can download for free in PDF format. These templates cover a wide range of scenarios, making it easier to find one that suits your specific needs. It’s always helpful to have options, especially when it comes to filing important documents like the 1040X form.

I hope you find these resources helpful in navigating the amendment process for your income tax return. Remember, it’s essential to review and double-check all the information you provide to ensure accuracy. If you have any doubts or questions, consider seeking assistance from a tax professional or referring to the IRS guidelines. Happy filing!